A few weeks ago, American Compass released Rebuilding American Capitalism, A Handbook for Conservative Policymakers. This Forbes column (American Compass Points To Myths Not Facts) provided a very brief critique of the handbook’s “Financialization” chapter, and Oren Cass, American Compass’s Executive Director, released a response titled Yes, Financialization Is Real.

Today’s Cato at Liberty post is the second in a series that expands on the original criticisms outlined in the Forbes column. (The first in the series is available here.) This post deals with American Compass’s claim that the financial sector has siphoned off “top business talent” to the detriment of the rest of the economy.

The evidence does not support American Compass’s claims. The post also points out the inconsistency between American Compass’s complaints about (allegedly) stagnant American income and an influx of people working in higher‐paying fields.

To recap, American Compass’s handbook states the following:

American finance has metastasized, claiming a disproportionate share of the nation’s top business talent and the economy’s profits, even as actual investment has declined.” [Emphasis added.]

The original critique was that American Compass failed to provide supporting evidence for these claims, and that such supporting evidence doesn’t exist. It also pointed out the number of people employed in the Finance and Insurance industry, as a share of total nonfarm employees, has barely budged from 4.5 percent since 1990.

To provide evidence that the nation is, in fact, losing its top business talent to the financial industry, Cass’s response pointed to two paragraphs in a separate report that Cass wrote, Confronting Coin‐Flip Capitalism. Our critique assumes that “coin‐flip capitalism” is the same phenomenon as “financialization.” The first of the two paragraphs is reproduced here:

Graduates of America’s top business schools provide a useful proxy for the attraction of various industries and, from 2015 to 2019, nearly 30% of graduates from Harvard, Stanford, Wharton, Booth, Kellogg, Columbia, and Sloan went into finance. In 2020, the finance industry was the most popular and offered the most generous compensation packages for graduates of the MBA programs at both Harvard and Stanford. [See also, our Guide to Private Equity.]

This first paragraph does not provide evidence that finance has claimed a disproportionate share of the nation’s top business talent. It merely refers to several years of placement data from some of America’s top business schools, not a systematic study. The paragraph provides evidence that a large portion of top business school graduates choose to work in finance. That fact is hardly surprising, and it is not evidence that the proportion has changed or that businesses have been harmed.

The second paragraph is reproduced here:

Engineers have likewise flocked to Wall Street, as compensation at equivalent education levels surged in finance as compared to engineering after 1980. The probability of an engineer switching to a finance career increased more than four‐fold from the 1980s to the 2010s; the share of “STEM” jobs in finance doubled over that period while the share in manufacturing fell by half. Lest one think these are the engineers who couldn’t hack it in engineering, Nandini Gupta and Isaac Hacamo of Indiana University’s Kelley School of Business find that “financial sector growth attracts exceptionally talented engineers from other sectors to finance.”

Citing three research papers, American Compass bemoans the finding that “Engineers have likewise flocked to Wall Street.” Our critique assumes that engineers should be included in the category of “top business talent.”

First, even if business majors and engineers do choose finance versus other fields, that fact alone says nothing about why they make such choices, much less whether such choices cause harm to the nation’s economy. Such choices could simply reflect that people tend to seek opportunities to earn higher compensation, and the outcome could be beneficial to the economy. And, in fact, between 1968 and 2022,[1] average annual real wage and salary growth was higher in finance than in several other sectors, including engineering. (See Figure 1.)

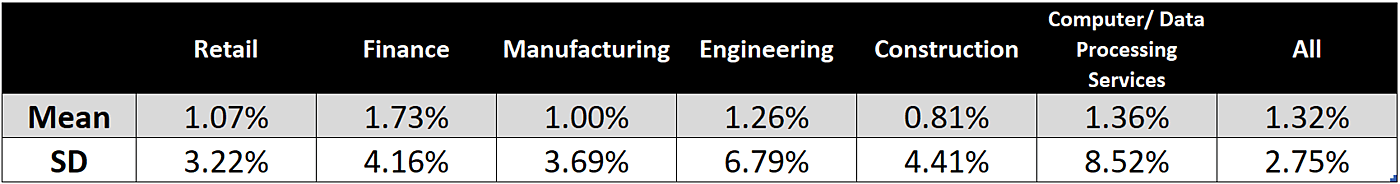

Average annual real wage and salary growth is 1.73 percent in finance since 1968, but 1.26 percent in engineering and 1.36 percent in computer services. Thus, even though wages in finance are lower than in computer sciences or engineering (see Figure 2), their higher growth rate could help explain why many people would choose finance jobs relative to other fields.

None of these facts are indicative of an economic problem. If American Compass believes that people earning so much more in the computer field harms Americans, they should say so. Similarly, if American Compass believes that a 0.47 percentage point difference in average income growth between the financial and engineering sectors reveals businesses have been harmed, they should state their hypothesis clearly and make an empirical case.

Surely, though, an organization such as American Compass, one that constantly complains about stagnant income, would not begrudge Americans for choosing to work in a higher paying field. (Figure 1 and Figure 2 also demonstrate that Americans’ income is not stagnant. Real wage and salary growth has been positive across almost all sectors and time periods, with cumulative growth of 71 percent even in the manufacturing sector. We’ll return to this issue in a future post.)

Of course, even this compensation growth data tells us very little about why the different rates of growth occurred in the various sectors. However, one of the academic research papers Cass cites in his response does provide an explanation for this difference. Specifically, we’re referring to the paper by Thomas Philippon and Ariell Reshef, titled “Wages and Human Capital in the U.S. Finance Industry: 1909–2006,” which was published in the prestigious Quarterly Journal of Economics in 2012.

In that paper, the authors show that the labor market in finance was artificially suppressed between 1940 and 1980 due to an over‐bearing regulatory environment. In other words, overall wages and employment in finance would have been much higher without the heavy regulation in that sector. Consequently, the uptick in wages and employment after 1980 are likely due to the finance labor market reverting back to its non‐suppressed state (similar to pre‐1940) after the regulatory environment changed (precisely what economics would predict). Here’s a quote from page 1552:

We find a tight link between deregulation and the flow of human capital in and out of the finance industry. In the wake of Depression‐era regulations, highly skilled labor leaves the finance industry and it flows back precisely when these regulations are removed in the 1980s and 1990s. This link holds for finance as a whole, as well as for sub‐sectors within finance. Our interpretation is that tight regulation inhibits the creativity of skilled workers.

So, this paper does not support American Compass’s position that anything bad has happened; instead, it argues that any employment increase seen in finance is essentially a reversion to a state where skilled workers’ creativity is no longer inhibited.

Another of the three papers is a Kelley School of Business working paper from 2022 by Nandini Gupta and Isaac Hacamo. This paper is an even stranger choice for American Compass to cite as proof of some kind of harm caused by financialization (or coin‐flip capitalism). It shows that the net effects of people working in finance boost entrepreneurship. Here is the relevant language (from two separate paragraphs on page 4 of the paper):

Our results show that the finance wage premium increases overall entrepreneurship. This may occur because engineer‐financiers are more likely to become entrepreneurs. Or, because talented engineers in finance facilitate entrepreneurship by others. We find that engineers who take finance jobs are less likely to subsequently start firms. Therefore, we study a potential peer effects mechanism where engineer‐financiers may help their classmates become entrepreneurs.

…

We find the following results: First, we show that top engineers exposed to a higher finance wage premium at graduation are more likely to take jobs in entrepreneurial finance (EF) jobs in venture capital, private equity, and investment banking. Second, we show that engineers who don’t take finance jobs are more likely to become transformational entrepreneurs the more classmates from the same school‐major‐graduation year who are in venture capital, private equity, and investment banking firms. For example, an engineer with 5 classmates in entrepreneurial finance jobs is 9% more likely to become an entrepreneur and 18% more likely to create a transformational firm that issues patents, employs workers, and has a successful exit, relative to the mean.

At the very least, the paper’s results are consistent with the literature on peer‐effects “whereby engineers in investment banking type jobs help their classmates start transformational firms.” Obviously, it’s very odd to cite this paper as evidence that financialization is some kind of blight on capitalism. It implies the opposite: the overall labor market trend is good for the economy.

The third paper is a 2022 working paper by Giovanni Marin and Francesco Vona, and the evidence it provides does not show that finance is now claiming a disproportionate share of STEM talent. For instance, the authors show that the probability a STEM graduate starts working in finance rose between 1980 and 2019, from 4 percent to 6.8 percent. However, they also report a substantial increase for non‐STEM graduates – it rose from 6.5 percent in 1980 to 8.2 percent in 2019. (See page 9.)

The authors of this third paper also report (see pages 3 and 4) that they “observe a pronounced task reorientation towards math in finance and business occupations, which is associated with a change in the types of education required in these occupations.” (Emphasis added.) In other words, they observe a change in education requirements for multiple occupations, one that (especially in finance) is “more pronounced among experienced workers.”[2] Additionally, the paper corroborates that the drift of STEM graduates to finance is simply a result of people finding the best match of talent and innovation:

These empirical patterns are associated with profound technological changes affecting the financial industry more than the rest of the economy. Finance is an information‐intensive industry that benefited from improvements in information and communication technologies (ICT) more than other industries did. The STEM biasedness in the demand of college graduates is consistent with the complementarity between ICT technologies and STEM graduates.

Finally, Marin and Vona report (see graph B on page 10) the share of hours worked by college graduates in the finance industry for both STEM and non‐STEM graduates between 1980 and 2020. Both STEM and non‐STEM groups display an increasing trend, and the share for non‐STEM graduates remains roughly two percentage points higher than for STEM graduates for the full period. Though not quite as damning as the previous two papers, this one, too, fails to support the idea that finance has started claiming a disproportionate share of talent.

So, on balance, none of this evidence – especially not the papers cited by American Compass – supports the idea that finance is responsible for robbing the nation’s businesses of talent. Nor, as American Compass argues in Confronting Coin‐Flip Capitalism, does any of this evidence support that finance is robbing talent “from the real economy” and “further discouraging productive investment.”

On page 102 of his book, Cass supports the “tracking of less academically talented students toward vocational training,” so he may have some optimal employment arrangement in mind for the financial sector. Perhaps someone else at American Compass has some idea what the optimal quantity of workers should be in the financial sector, but the “Financialization” chapter does not mention it.

In the next post, we will discuss claims involving financialization’s alleged effect on profits.

[1] Figure 1 and Figure 2 report annual average growth rates and actual amounts, respectively, for real annual pre‐tax wage and salary income, by sector, from 1968 to 2022, using the IPUMS-CPS, University of Minnesota, www.ipums.org.

[2] Figure VI (on p. 1571) from Philippon and Reshef (2012) also confirms this finding. Finance jobs dramatically increased in complexity while tasks in the rest of the labor market became substantially less complex.