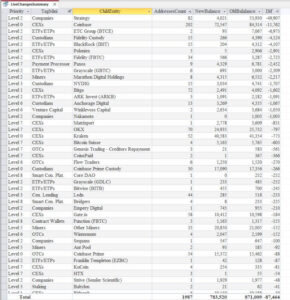

2025 was officially a wipeout year for US spot Bitcoin ETFs – now flat YoY and down $48B since October

U.S. spot Bitcoin ETFs gave back nearly all of their 2025 gains after hitting a cycle high in early October, with total net assets sliding to $120.68 billion as of Dec. 4, down $48.86 billion from the Oct. 6 peak.

The drawdown leaves the category essentially flat year-over-year, sitting just $30 million below the $120.71 billion recorded on Dec. 16, 2024, emphasizing a “wipeout” year in which big price-driven swings failed to translate into sustained net growth for the ETF complex.

The year-to-date flow picture diverged from the asset figure.

2025 net creations totaled $22.32 billion through Dec. 4, yet the October-to-December price drawdown in bitcoin cut fund assets back to where they were a year ago.

Since Oct. 6, cumulative net outflows totaled $2.49 billion, a small share of the $48.86 billion in AUM decline, with the residual move attributable to price and unrealized profit and loss.

That mix frames a year in which issuance demand continued, while BTC’s late-year retracement erased the asset’s gains recorded into early October.

Second-quarter creations reached $12.80 billion, and third-quarter creations added $8.79 billion, while fourth-quarter creations turned marginally negative through Dec. 4 at $0.20 billion in net redemptions.

The latest 30-day window showed $4.31 billion of net outflows, indicating that Q4 cooled after a strong middle part of the year.

Even after the fourth-quarter slowdown, cumulative net inflows since launch stood at $57.56 billion, stressing that the structural base of issued shares remains above the level implied by price alone.

The gap between actual AUM and a flow-only counterfactual since Oct. 6 illustrates the dynamic. Starting from the $169.54 billion peak and mechanically adding only daily creations and redemptions yields a path that would have kept assets near that starting point, while the observed line fell with BTC’s drawdown.

The difference between those two paths, shown in the “AUM vs flow-only” analysis, quantifies the price or PnL component that drove the decline.

By the same logic, comparing today’s AUM to the Dec. 16, 2024 anchor with cumulative 2025 inflows isolates the past year’s attribution, where positive flows were offset by negative price marks, leaving assets near flat.

Investors focused on fund health will parse the spread between flows and performance to assess resilience, liquidity, and potential supply overhang in the primary market.

The positive 2025 flows mean authorized participants created shares net across the year, so the product set did not suffer broad redemption pressure until late in the year. Price, not redemptions, explains most of the AUM reset from the October high.

That matters for secondary market conditions because persistent outflows would point to different dealer balance sheet loads and secondary spreads than a price-led move with stable share counts.

The “nothingburger” year-over-year comparison is specific to the chosen dates, which center on the latest valid row in the dataset and the prior mid-December reference.

As of Dec. 4, total assets came in only $30 million below the Dec. 16, 2024, reading, a rounding-level change for a product suite that scaled above $120 billion. The interpretation, for readers tracking structural adoption via creations, is that a flat YoY AUM print does not imply negligible demand.

It reflects that the fourth-quarter price decline countered earlier inflows. The datasets and charts included, spanning total AUM, daily flows, and cumulative inflows since launch, align with this decomposition.

The intra-quarter shift is visible in the daily series. Through the spring and summer, creations clustered on strong price days, then waned into the fall. After Oct. 6, redemptions increased, and the 30-day net flow turned negative in early December.

The magnitude remained modest relative to the total, at $2.49 billion in net outflows over the period, reinforcing the mechanical point that the AUM slide since the peak was primarily a function of mark-to-market.

Below are the core figures referenced for clarity.

| Metric | Value | Date / Period |

|---|---|---|

| Total AUM | $120.68B | Dec. 4, 2025 |

| AUM peak | $169.54B | Oct. 6, 2025 |

| Change since peak | −$48.86B (−28.82%) | Oct. 6 to Dec. 4, 2025 |

| YoY AUM | $120.71B → $120.68B | Dec. 16, 2024 to Dec. 4, 2025 |

| 2025 YTD net flows | +$22.32B | Through Dec. 4, 2025 |

| Flows since Oct. 6 | −$2.49B | Oct. 6 to Dec. 4, 2025 |

| Cumulative net inflows since launch | +$57.56B | Through Dec. 4, 2025 |

| Latest 30-day net flows | −$4.31B | Through Dec. 4, 2025 |

| Quarterly flows | Q1 +$0.93B, Q2 +$12.80B, Q3 +$8.79B, Q4 to date −$0.20B | 2025 |

For context and reproducibility, AUM corresponds to total net assets in USD, and flows correspond to the daily total BTC inflow.

The simple attribution of the AUM change from Oct. 6 to Dec. 4 equals net flows over the interval plus a price or PnL term. Using that decomposition, the $48.86 billion decline approximates to $2.49 billion of net outflows and about $46.37 billion of price or PnL.

The total AUM chart shows the October crest and the subsequent fade into December, the daily flows chart shows Q2 and Q3 strength with Q4 softness, and the cumulative net inflows chart confirms that creations remain positive since launch.

As framed, the headline takeaway is that 2025 brought positive issuance, while the October retracement in BTC capped the year with assets near last December’s level and well below the early October peak.

The post 2025 was officially a wipeout year for US spot Bitcoin ETFs – now flat YoY and down $48B since October appeared first on CryptoSlate.